If you’re like many families or small businesses these days, subscriptions are part of life. They include things like streaming services, food deliveries, software tools, gym access online storage, and news platforms. These services offer convenience but can also let unnoticed charges add up. That $9 plan turns into a $27 premium option without you even paying attention, and you might not even use it.

For a lot of Americans, recurring payments have become one of the biggest ways people overspend without noticing. It isn’t just families dealing with this issue, businesses face it too. Teams sign up for software they stop using, free trials turn into charges after they end, and companies pay for similar services more than once. Without a clear method to handle it, wasted subscriptions can quickly drain budgets.

Subscription management tools solve this problem. These tools let you:

- keep track of all recurring payments in one spot

- find subscriptions that are duplicated or not being used

- prevent unexpected renewals

- cut down monthly expenses

- take control of your financial situation with ease

I’ve listed the 10 top tools for managing subscriptions that you can rely on today. These tools were picked because they’re simple to use, offer great automation, provide precise tracking, and come with useful features to help individuals and businesses manage their finances better.

Key Features of a Good Subscription Management Tool

If you need to handle your personal subscriptions, manage a household budget, or oversee multiple tools for a business, the best platform should simplify the process. After reviewing common user challenges, here are the must-have features to consider.

1. Find Subscriptions Automatically

You shouldn’t have to sift through all your bank statements just to spot recurring charges. The best tools can check your accounts, find hidden subscriptions, and show you where your money is going.

2. Everything in One Simple Dashboard

A good subscription management tool should clearly show upcoming renewals, your total monthly spending, how often you actually use each service, and any subscriptions you no longer need or that have expired. It should also flag price increases you may have missed. When everything is visible in one place, managing subscriptions becomes far simpler and more effective.

3. Alerts Before Charges Hit Your Account

Life keeps getting busier, but the right tools can step in by alerting you before money is withdrawn from your account. These notifications can help you avoid forgetting to cancel auto-renewing free trials, catch unexpected price increases, stay ahead of surprise annual charges, and prevent old or expired cards from being charged by mistake.

4. Simple Cancellation Help

Some companies make canceling hard. Thanks to subscription tools, you can lower your stress because they’ll show you the fastest way to cancel, give you one-click cancel options if available, and save a record of what you’ve already done.

5. Tracking Usage & Spotting Waste

Many people and businesses don’t notice how much they spend on subscriptions they use. The best tools help you figure out:

- Software you almost never use

- Apps you’re paying for more than once

- Features you’re charged for but don’t use

- Free trials that switched to paid plans

6. Spending Reports & Money Tracking

To stay better organized, households and teams need tools with reports you can export, types of spending, and calendars for renewals, which simplify how you budget.

7. Integrations That Work

Connecting with tools for accounting, ERP systems, CRM platforms, or payment solutions help businesses create a unified financial overview instead of messy data all over.

Top 10 Tools to Manage Subscriptions, Stay Organized, and Cut Waste

The tools listed here tackle different problems. Some fit for families, others for growing teams, and a few cater to organizations handling many subscriptions, whether dozens or hundreds. But don’t worry, after reading carefully, you’ll find the tool that matches what you’re looking for easily.

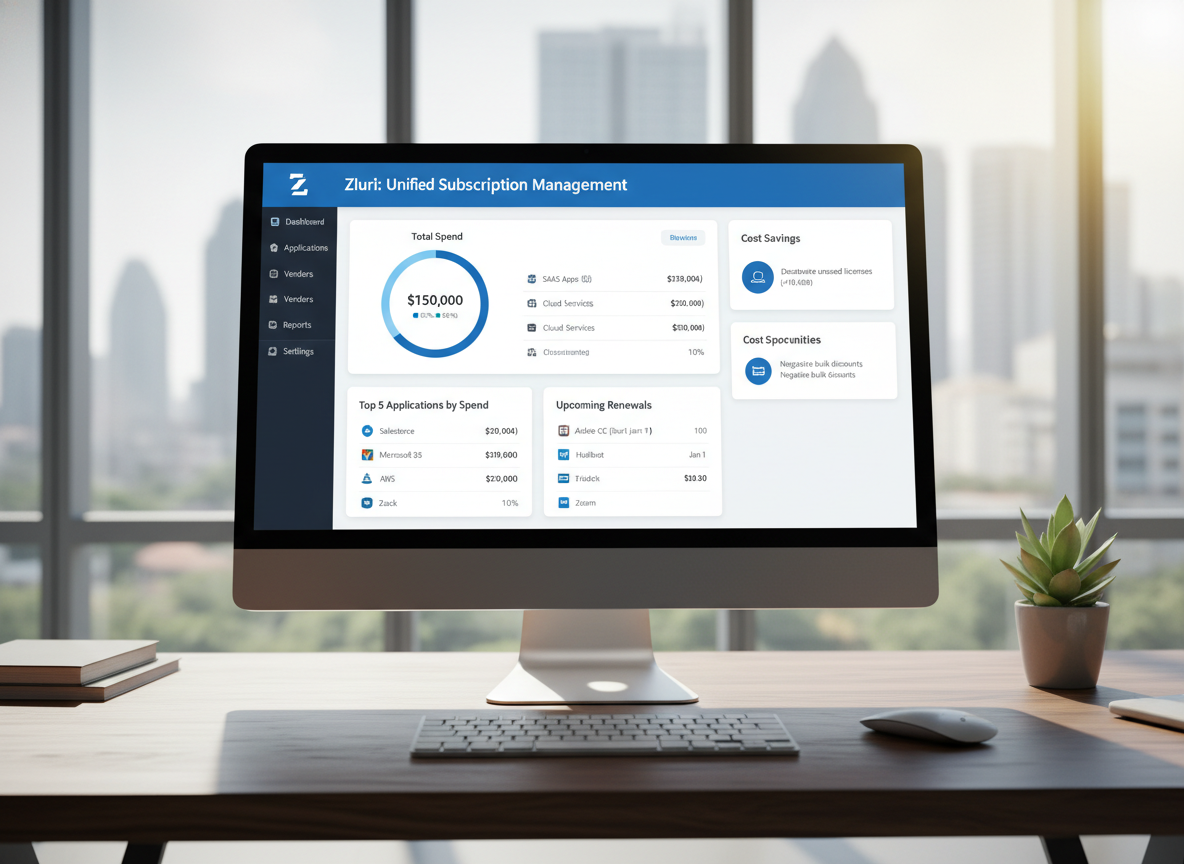

1. Zluri

Zluri is best for companies with big SaaS stacks needing better oversight and cost savings. It lets companies see all the SaaS tools their employees are using. Plus, it uses nine ways to find apps, even the ones your team doesn’t remember, checks how often people use them, and points out where money is wasted.

What makes it a favorite:

- Finds hidden subscriptions

- Cuts costs by removing unused tools

- Keeps track of renewals to avoid unexpected fees

- Offers strong security and compliance checks

- Helps streamline SaaS management

Why it’s effective: Zluri works great for businesses that want to stop wasting money on unused software and avoid last-minute renewals. Its cost-saving tools allow companies to lower expenses without interrupting daily work.

2. Zoho Subscriptions

If you’re working in small companies needing simple recurring billing and easy customer tracking, Zoho Subscriptions is absolutely suitable for you. It simplifies managing customer subscriptions and recurring payments without making things too complicated. It fits well within the Zoho suite making it a reliable option for small or medium-sized businesses.

Why it’s useful: It automates and organizes your billing to make it predictable and straightforward.

The key features include automated recurring billing, support for flat-rate, tiered, and usage-based pricing models, and a built-in dunning system that helps reduce failed payments. It also offers a customer self-service portal and support multiple languages and currencies, making it suitable for global and growing businesses.

3. Sage Intacct

Best suited to: Teams focused on finance needing precise accounting-level accuracy. Sage Intacct caters to organizations requiring detailed financial reporting and automated handling of revenue recognition. It proves helpful to nonprofits or businesses managing multi-entity accounting structures.

Key features:

- Tracks subscriptions in one place

- Automates invoicing and billing

- Offers strong tools for revenue recognition (ASC 606 and IFRS 15)

- Provides in-depth subscription metrics and reporting

What makes it unique: It ensures businesses can trust that every single dollar is tracked and recognized, which is essential as they grow.

4. Paddle

Paddle specializes in handling billing and taxes, providing live analytics, tracking churn and retention, and easy setting up with responsive support. It’s suitable for new companies selling digital products across the globe. Paddle also acts as a Merchant of Record by managing taxes, compliance recurring billing, and payments worldwide.

Why it works well: It helps businesses sell without worrying about tax or compliance problems.

5. Recurly

Best suited for: Companies looking to improve retention and recover payments. It stands out with its dunning tools. By retrying failed payments, sending timely reminders, and managing the process, it recovers lost revenue.

The main benefits include seamless handling of recurring billing, advanced workflows that streamline dunning and payment recovery, and access to real-time subscription metrics and analytics. In addition, Recurly offers strong security measures that comply with PCI standards, helping protect sensitive payment data. It’s ideal for teams who are frustrated with losing customers because of failed or expired payment cards.

6. Zuora

Enterprises that manage complex subscription setups are the target audience of Zuora because it manages large-scale subscription operations, whether it’s telecom businesses or SaaS companies with complicated models based on usage. It simplifies complex tasks but keeps teams operating.

What sets it apart is its flexible pricing and packaging options, automated billing and revenue recognition, smooth integration with CRM and ERP systems, and strong security and compliance controls that support reliable, scalable operations.

7. Sticky.io

Key advantages:

- Handles subscription lifecycle from start to finish

- Supports various billing approaches

- Provides in-depth analytics and customer insights

- Includes effective tools to retain customers

Ideal for: Ecommerce brands with subscription models. Sticky.io provides a robust platform to manage recurring sales for D2C brands offering subscription boxes, beauty items, consumables, and more. Plus, it helps increase customer lifetime value by extending how long subscribers stay.

8. Maxio

Maxio combines tools for billing, revenue tracking, and analytics in one platform tailored to SaaS needs. It offers automated billing for subscription-based plans, helps maintain clear and compliant revenue timelines, provides real-time data analysis and forecasting, and is built to scale efficiently as a business grows. It’s ideal for SaaS companies aiming to simplify financial operations.

9. Billsby

Billsby helps businesses start subscription services, handle customers, and monitor income without a difficult onboarding process with some features such as: simple checkout and user account tools, automated payments and overdue payment handling, customizable plans and usage monitoring, and integrations with leading business software. Because Billsby is easy and quick for beginners, it’s suitable for companies wanting easy setup and customization options.

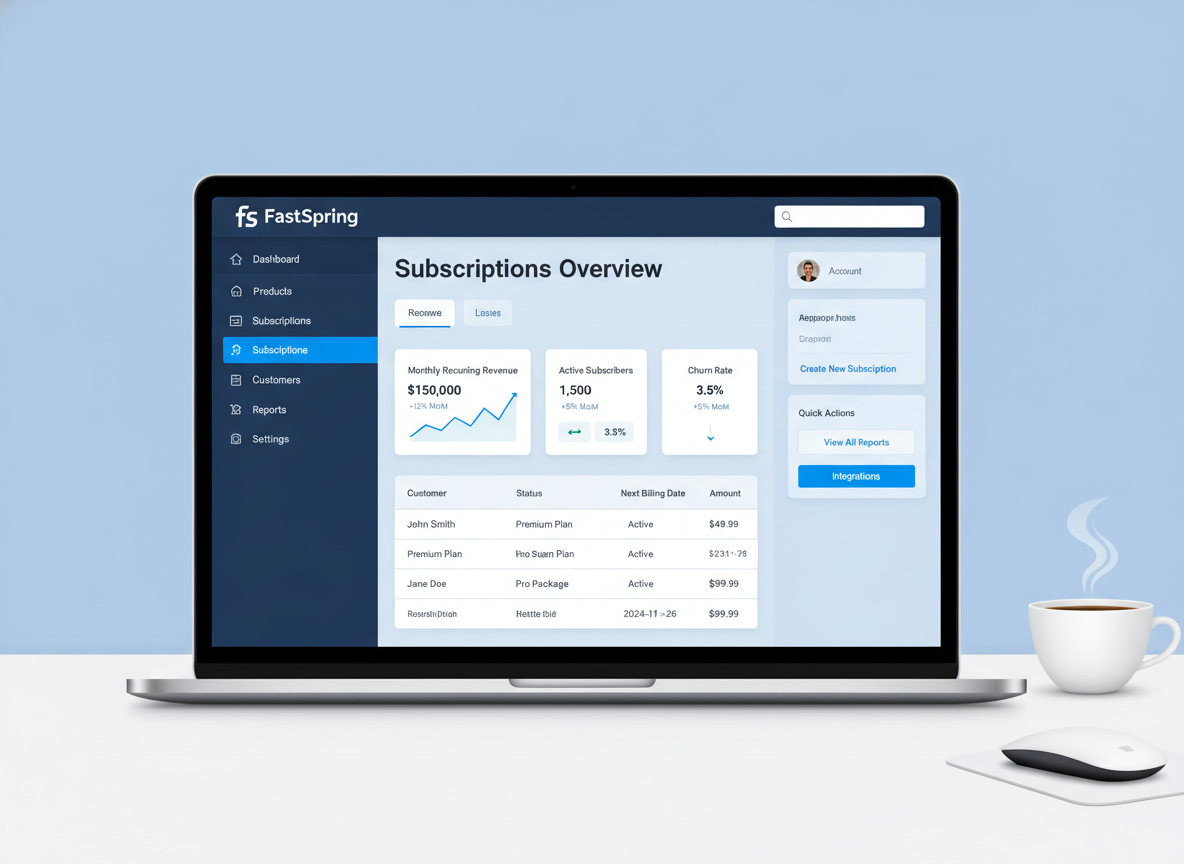

10. FastSpring

FastSpring is best suited for international digital companies that rely on flexible payment options to scale globally. It works especially well for SaaS providers and digital product vendors that need a dependable way to sell across borders without added complexity.

The platform supports multiple currencies and payment methods, handles billing and invoicing automatically, and offers user-friendly dashboards for managing sales and subscriptions. With strong data security built in, FastSpring helps teams expand internationally while avoiding the challenges of navigating complex regulations and compliance requirements.

How to Pick the Right Subscription Management Tool

Here’s a simple guide to help you decide whether you’re managing personal finances or running a business.

| Purposes | Services | Suggestions |

|---|---|---|

| To manage household budgets |

|

Choose a service that helps you find and stop unwanted subscriptions |

| To manage small businesses |

|

Zoho Subscriptions or Billsby |

| To help medium or expanding SaaS companies |

|

Paddle, Recurly, or Maxio |

| To support enterprises |

|

Zuora, Sage Intacct, or Sticky.io |

5 Ways to Keep Your Money in Check and Stop Wasting on Subscriptions

1. Check your subscriptions every three months: People often forget how small monthly charges add up. Reviewing them helps avoid losing money over time.

2. Find and cancel duplicate services: Paying for two tools that do the same job happens way more often than you’d expect.

3. Schedule reminders for yearly renewals: Yearly plans can feel like a financial surprise when the charge appears out of nowhere.

4. Focus on how much you use something: Even a cheap service is a waste of cash if you rarely or never touch it.

5. Negotiate prices or switch plans: Lots of companies provide things like loyalty discounts, downgrade choices, or personalized plans. Just asking can often lower your bill.

Final Thoughts

Keeping track of recurring expenses doesn’t need to be stressful. Whether you’re handling personal subscriptions or juggling tons of SaaS apps, the tools mentioned here can give you simple and effective ways to manage your finances in today’s subscription-filled world.